PayPal Chargebacks Часто задаваемые вопросы PayPal Chargebacks Frequently Asked Questions !

What is a chargeback?

There are three main reasons a buyer will do this:

Chargebacks are initiated and handled by the buyer's credit card issuer-not by PayPal-and therefore will follow that company's regulations and timeframes. That said, PayPal often plays a role in resolving chargeback disputes.

What's the difference between a chargeback and a PayPal dispute? The credit card issuer decides who wins the chargeback, and not PayPal. A PayPal dispute is the first step in the PayPal buyer complaint process. During the dispute phase, buyers and sellers "meet" in the PayPal Resolution Center to try to come up with a mutually acceptable solution.

What is the difference between a chargeback and a PayPal claim? The credit card issuer decides who wins the chargeback, and not PayPal. A PayPal claim is the second step in the PayPal buyer complaint process. If a buyer and seller cannot resolve their dispute on their own, the buyer may escalate the dispute to a claim. PayPal will then provide a final decision.

Seller Chargeback FAQs

You'll find more helpful tips on safer selling General Advice:

Be Clear Buyers don't like surprises, so it's always a good idea to provide clear, detailed descriptions and photographs, especially for international buyers who may not speak your language.

Returns Make sure it's easy for your buyers to find and understand your return policy.

Communicate Buyers appreciate sellers who answer their questions promptly.

Pre-Payment Precautions:

Shipping Tips:

Track Your Packages Once you receive your tracking number, send it on to the buyer. And when the package arrives, it's a good idea to request the proof of delivery receipt and keep it somewhere safe.

Insure Your Packages Get shipping insurance. It'll keep you covered if your package gets lost.

Keep Buyers Informed Once you've received payment for a sale, give your buyer an estimated delivery date. And if for some reason you don't manage to send it out on time, be honest. It will set realistic expectations for your customer, and could prevent inquiries or disputes regarding the status of their order

Communication Tips: In the event of a dispute, try to set a constructive tone, and give the buyer the benefit of the doubt. See if you can come up with a solution that benefits both parties, and remember that good customer service can go a long way toward resolving problems.

Why do some chargebacks occur long after a payment has been received? Certain laws and credit card issuer policies allow buyers to file chargebacks weeks or months after the original transaction took place. If a buyer waits and files later, you may encounter a temporary hold on funds in your PayPal account, relating to a transaction from long ago.

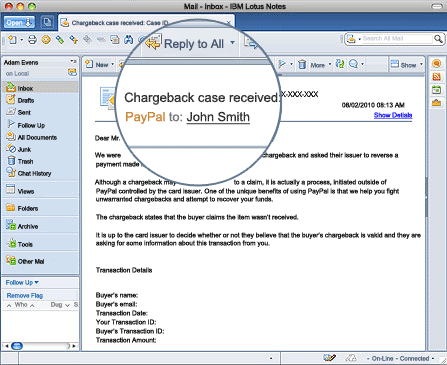

How will PayPal let me know a chargeback has been filed against me?

Certain laws and credit card issuer policies allow buyers to file chargebacks weeks or months after the original transaction took place. If a buyer waits and files later, you may encounter a temporary hold on funds in your PayPal account, relating to a transaction from long ago.

What happens to my funds when a chargeback is filed against me?

A temporary hold is placed on the funds in question until the matter has been resolved. This means you cannot withdraw or spend these funds until the dispute has come to an end.

If the dispute is found in your favor, the hold will be immediately released, and you'll have full access to your funds.

If the dispute is not found in your favor, the funds will be removed from your account and credited back to the buyer.

Please note - it may take your buyer's credit card company up to 75 days to resolve a chargeback and come to a final decision.

Can receiving a chargeback impact my eBay feedback?

Can receiving a chargeback impact my eBay feedback?

Not directly, as the chargeback system is provided by third-party credit card companies, and is completely independent from eBay feedback. However, a buyer is free to provide feedback at any time - and if they've had a bad experience, they might have something to say about it.

What information should I provide to increase my chances of winning a chargeback dispute?

If a PayPal dispute or a PayPal claim is decided in my favor, will I be covered against any related, subsequent chargebacks?

A chargeback, also known as a reversal, is when a buyer asks their credit card issuer to reverse a transaction after it has been completed. It is available only to users who make a payment funded by their credit or debit card.

Avoiding Chargebacks:

Any time credit card payments are involved in a transaction, there's always the risk of a chargeback. Sometimes buyers are not satisfied with their purchases, or their order never arrives, or their credit card has been used fraudulently.

Many sellers factor potential chargeback losses into the cost of doing business. That said, there are some steps you can take to reduce your risk. It's wise to keep buyers well informed, maintain good records, and pay attention to our Communication Tips, including the following:

Provide Contact Information

Buyers may not resort to a chargeback if they can talk to you about the issue first. Provide an email address or phone number, or even call buyers in advance when you're selling higher priced items.

Be Responsive

No one likes to wait, so do your best to respond quickly and professionally to all reasonable buyer inquiries.

Suggest Dispute Resolution

If a customer tells you that they intend to file a chargeback with their credit card company, ask them to open a dispute in the PayPal Resolution Center instead. This will give you and your buyer the chance to work things out on your own.

Provide a Clear Return Policy

Make sure your return and refund policies are easy to find and understand on your website and all your auction listings.

Please note: some laws and credit card issuer policies stipulate that buyers have chargeback rights for merchandise that is not delivered or is defective, even if your policy indicates that all sales are final and that you do not allow returns.

Following these guidelines will help you reduce your risk. Equally important, however, is being aware of chargeback fraud.

Prevent the Top 3 Chargeback Claims

- The item never arrived:Give your buyers realistic delivery dates so they don't prematurely file a chargeback. Ship packages with tracking numbers and signature confirmation to provide proof of receipt. (Postal insurance is also helpful - you can be reimbursed if the package is lost.)

- The item did not meet the buyer's expectations:Make sure you describe items as accurately as possible. Provide clear images and measurements to minimize confusion.

- The item was damaged:Credit card companies may allow chargebacks for damaged or defective merchandise, even if your return policy states that all sales are final. Purchase postal insurance when you send the item to help reduce potential loss

While most buyers file chargebacks for reasons they believe are legitimate, there are criminals out there who try to take advantage of the system.

The claims most often exploited for chargeback fraud are:

- A scammer makes a legitimate purchase - but claims the transaction was not authorized.

- A criminal pretends an item never arrived, or lies and says it arrived significantly different than it was described.

Knowing about chargeback fraud helps prevent you from becoming a victim. It is also a good idea to familiarize yourself with the ways to reduce the risk of legitimate chargebacks.

Learn more about avoiding and dealing with all types of fraud.

No comments:

Post a Comment